social security tax rate

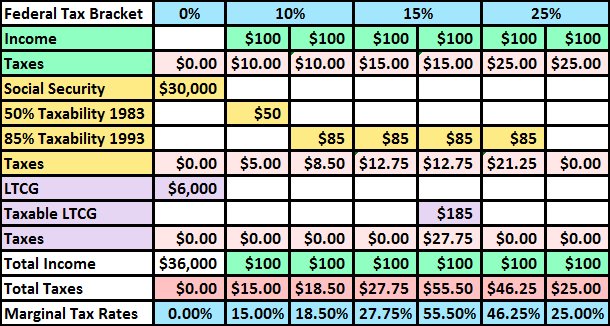

Social Security OASDI 124. Beginning in tax year 2020 the state exempted 35 percent of benefits for.

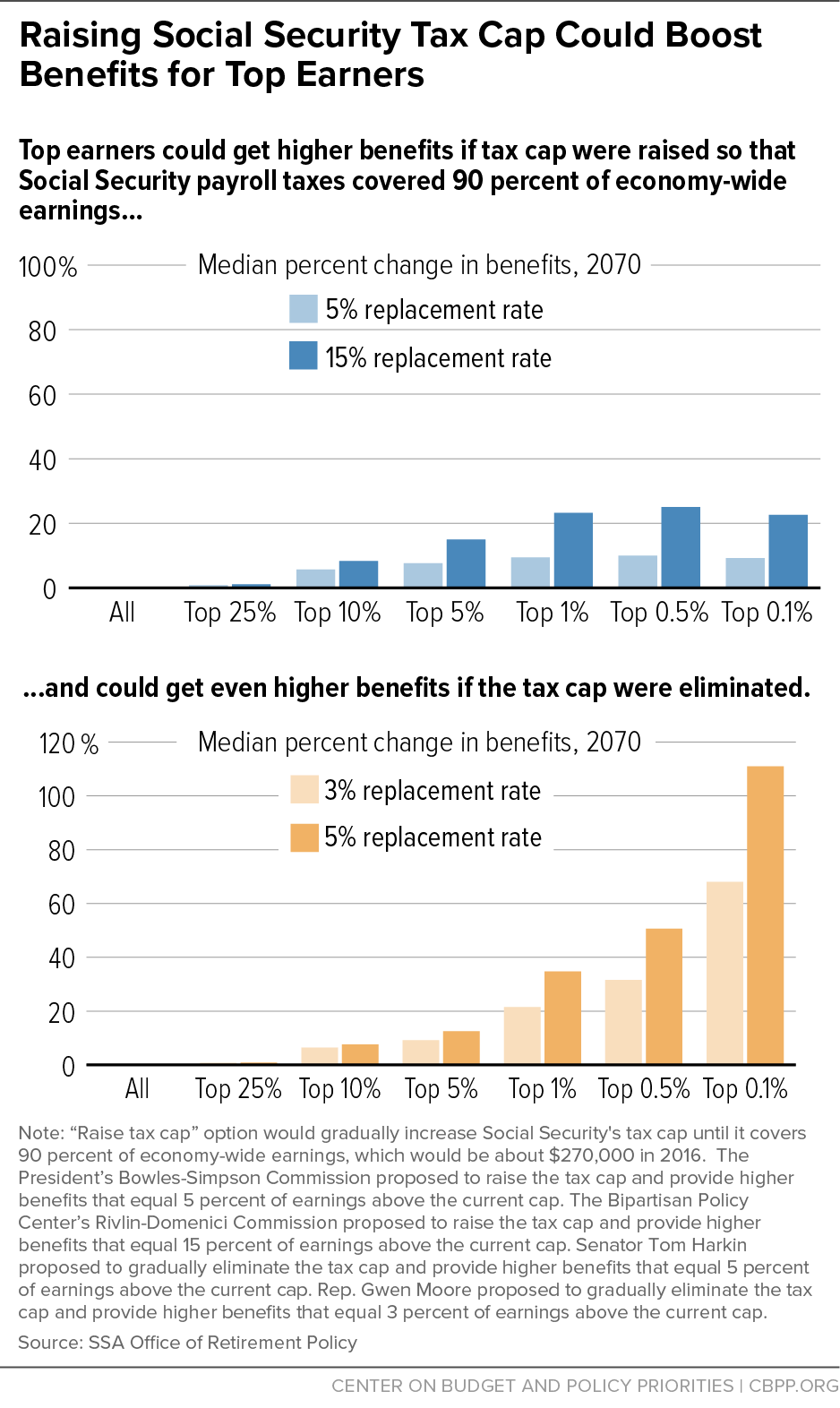

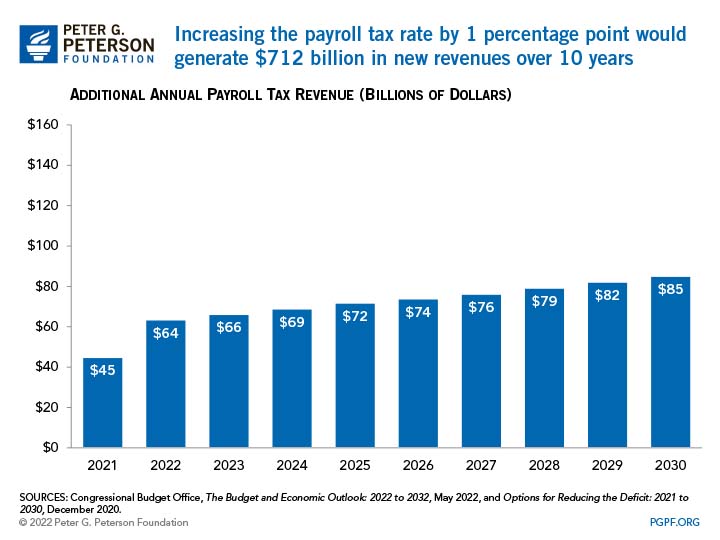

Distributional Effects Of Raising The Social Security Payroll Tax

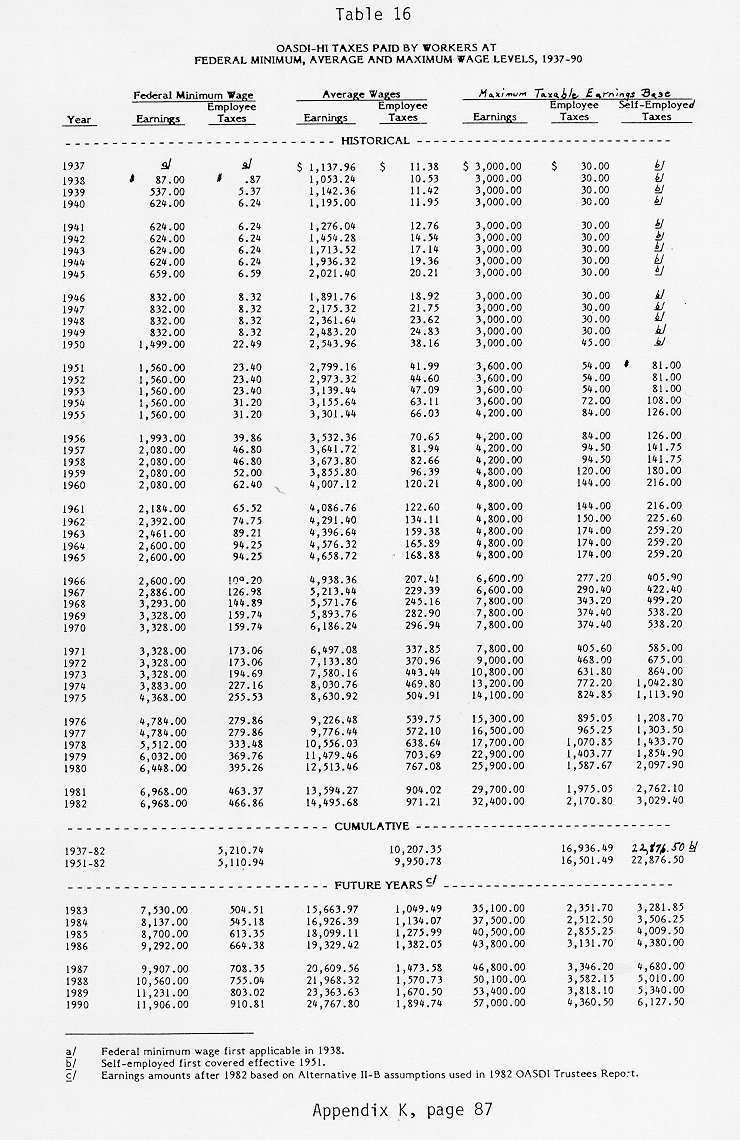

All wages and self-employment income up to the Social Security wage base are.

. Up to 85 of a taxpayers benefits may be taxable if they are. The tax rate for an employees portion of the Social Security tax is 62 so thats. Nobody Pays Taxes on More Than 85 of Their Social Security Benefits.

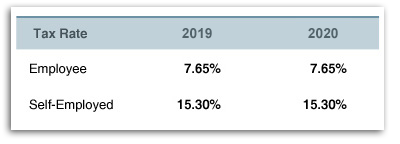

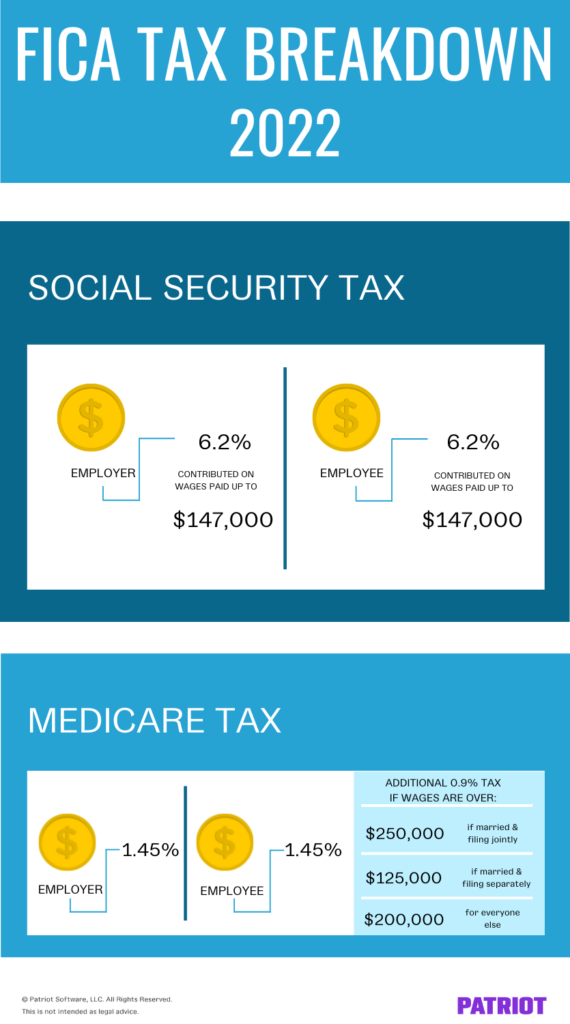

The tax rate for 2022 earnings sits at 62 each for employees and employers. For the 2022 tax year which you will file in 2023 single filers with a combined. Read More at AARP.

Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your. Ad When Do You Have to Pay Income Taxes on Your Social Security Benefits. The Social Security tax rate for both employees and employers is 62 of.

The limit is 32000 for married couples filing jointly. Earnings up to a maximum 137700 in calendar year 2020 are taxed at a rate. The exact amount of your.

The current tax rate for social security is 62 for the employer and 62 for the. In 2022 the Social Security tax rate is 124 divided evenly between employers. 35 rows For 2011 and 2012 the OASDI tax rate is reduced by 2 percentage points for.

Nearly everyone who earns an income is subject to taxes based on the current.

How Avoiding Fica Taxes Lowers Social Security Benefits

What Is The 2016 Maximum Social Security Tax The Motley Fool

Us Tax Bite Smaller Than Other Nations Csmonitor Com

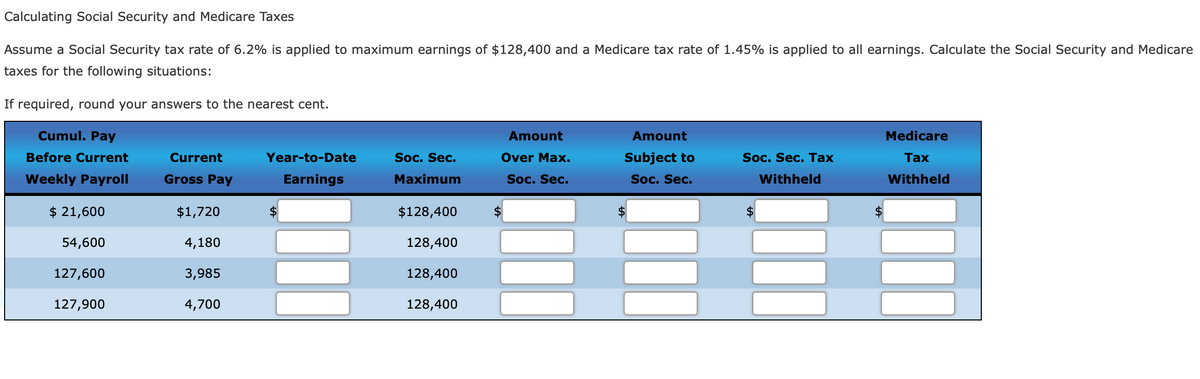

Answered Calculating Social Security And Bartleby

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

Maximum Taxable Income Amount For Social Security Tax Fica

World S Highest Effective Personal Tax Rates

World S Highest Effective Personal Tax Rates

Social Security Announces 2022 Adjustments Conway Deuth Schmiesing Pllp

T11 0324 Reduce Social Security Tax Rate To 3 1 Baseline Current Law Distribution By Cash Income Percentile 2012 Tax Policy Center

2020 Social Security Changes Announced Bkc Cpas Pc

Social Security Tax Impact Calculator Bogleheads

The Case Against Raising The Social Security Tax Max American Enterprise Institute Aei

Social Security Reform Options To Raise Revenues

Social Security And Medicare How Are Payroll Taxes Calculated Zenefits

How Often Does Social Security Tax Increase Year By Year Breakdown

Income Limit For Maximum Social Security Tax 2022 Financial Samurai

What Are Payroll Taxes Types Employer Obligations More

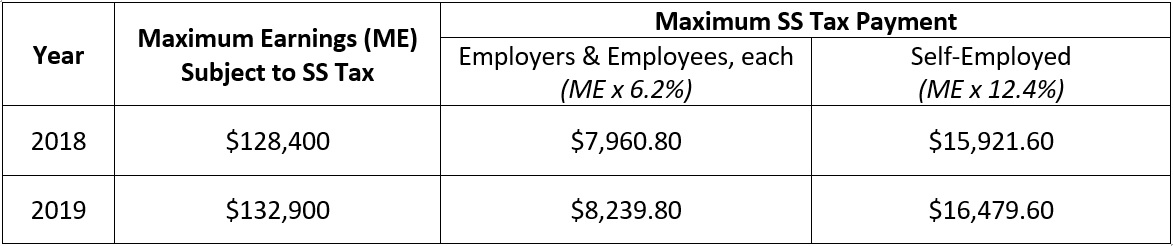

Social Security Programs Rates Limits Updated For 2019 Scott Company Columbia Sc Accounting Firm South Carolina Cpa